Whether you require the most short-term financing or maybe just have to comprehend your own dreams at some point, Alpine Credits is the best banking substitute for letting you influence the value of your property

The majority of people consider leveraging guarantee in their home once they you prefer currency because the a past resorts. But that is incorrect. You reside your very best collateral, which you can use to your benefit. Utilized proactively, a home security loan will help improve your finances, and your existence, in almost any indicates. We talked to Colin Atwood, Standard Manager, regarding Alpine Credits from the some of the self-confident-and you may profitable-activities to do that have a house security mortgage, We work with Equity Lending. When you yourself have centered enough guarantee of your house, you will be quickly approved, claims Atwood. It is your finances which can be used in several implies, such:

Loan providers examine borrowing from the bank against it reduced chance, which means you likely will have the lowest funding funds prices, that have down notice payments-which means restriction cash in your pocket

- Carrying out a corporate

Within current world, where lots of tasks are unstable, undertaking your own business , sometimes once the a full-big date agency or an area-hustle, would-be a very important funding on the upcoming income.

Loan providers check credit against it lowest exposure, and therefore you likely will have the reduced investment money prices, with down attract payments-and this form restrict money in your pocket

- Remodeling to earn more income

Remodeling your property is not a cost-its an investment. Building a connection, completing the basements , otherwise and work out numerous enhancements just produces your house a great deal more valuable. Whether your upgrade to offer or perhaps to create accommodations space to create during the extra income, the benefits you devote have a tendency to more than covers the cost of interest into the a loan. Home improvements still cost money, which is where a supplementary $10,100000 out of a decreased-notice home equity mortgage may come in the helpful.

Lenders evaluate credit against it as lowest risk, meaning that you might get the lowest financial support loans costs, having down interest payments-which mode limit profit on your own wallet

- Purchasing a residential property

Taking out fully a vintage mortgage buying a residential property normally be challenging-and you may high priced. Extremely finance companies need you to entice enough non-local rental earnings and work out your own monthly installments, that is towards the top of your pre-present primary homes expenditures. To purchase an investment property with the aid of a home security financing will be much easier, and less costly.

Loan providers look at borrowing from the bank facing it as lower chance, which means that you likely will have the lower financing funds costs, that have all the way down appeal payments-which setting limitation cash in your wallet

- Financial support a degree

Few things become more beneficial than simply education. Sadly, few things are also costly. Investing in your kid’s degree using a mortgage otherwise beginner financing can lead to debt for your requirements or initiate your youngster away with a high-attract obligations early in existence. Purchasing the amount even when a property security loan produces alot more monetary sense. In these days out-of job suspicion, many people are and lso are-teaching by themselves. A property guarantee loan is going to be a stronger financial support in your individual upcoming generating possible too.

Loan providers glance at borrowing from the bank up against it reduced risk, meaning that you likely will get the low financial support financing costs, having all the way down notice payments-and that means limitation funds on your own pocket

- Combining your debt

Particular loans will be notoriously difficult to procure away from antique financial institutions, but a good $10,one hundred thousand domestic security financing will be the raise you will want to get the company up and running

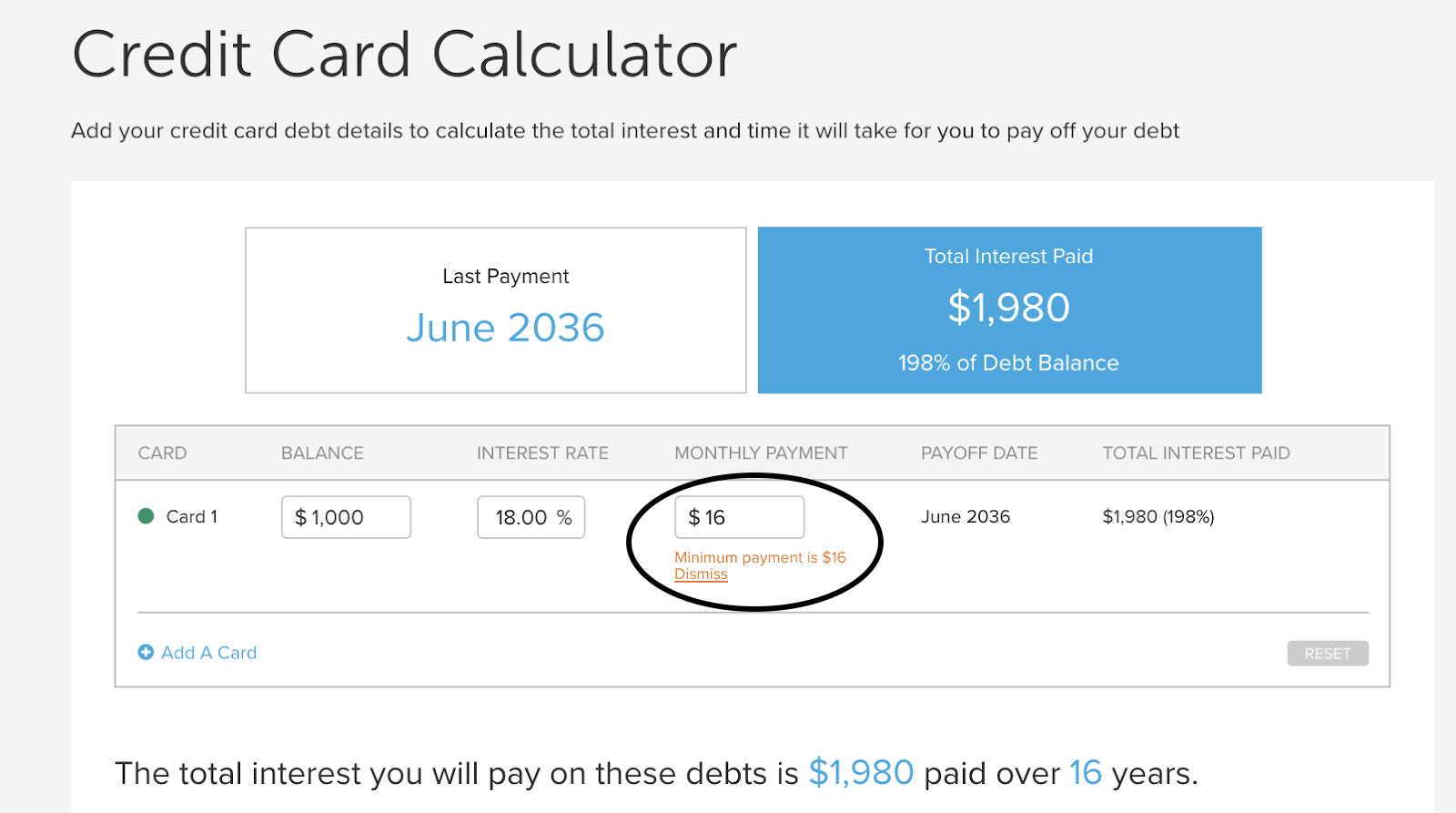

For those who have way too much loans pass on across the several handmade cards, signature loans, and/or lines of credit, merging her or him helps you greatest make a record by the merely having to cope with an individual payment. Rates of interest getting debt consolidation funds are usually lower than just pricing given by credit card companies, specifically if you fool around with a property equity mortgage.

Lenders take a look at borrowing from the bank up against it low chance, and thus you might have the reduced financing fund costs, with straight down appeal repayments-and that mode limit funds in your pocket

- Lightening dollars-flow affairs

The brand new COVID-19 pandemic has upended man’s resides in indicates they never ever expected. Unfortuitously, this has remaining of several requiring short-term investment, especially those that are thinking-functioning. Good $ten,000 domestic equity mortgage would be just the procedure needed to help you to get as a result of a time of adversity and you may uncertainty.

There are many different implies an excellent $10,100 house guarantee financing may help replace your lifestyle-and you can Alpine Credits may help. For over 50 years Alpine Credit features helped Canadian property owners have the household collateral loans they require, once they need it, aside from its credit years or income. It give in accordance with the readily available guarantee in their home. The new approval processes is not difficult, effortless, and focuses primarily on the amount of equity you really have manufactured in your residence, rather than credit scores, that’s what most finance companies come across.